Money You Have = Money You Make – Money You Spend

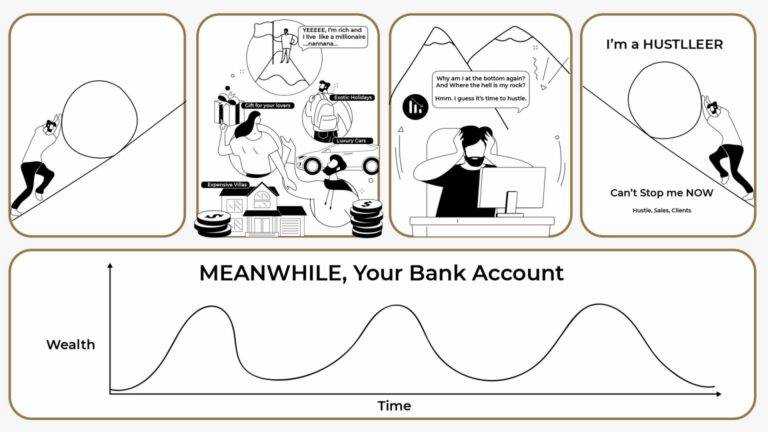

I don’t know about you, but I’ve been on multiple financial rollercoaster rides featuring:

Periods of intense hustle when I filled my bank account with cold-hard cash…

Followed by periods of blowing that money away. And back to hustle mode again. Rinse and repeat. Very much like Sisyphus pushing a rock up the mountain.

You may recognize the pattern yourself… (for visual aid, check Figure 1.)

You hustle. You close some sales and land clients. Then spend $$ to celebrate. You hustle to deliver for your new clients. Then pop that champagne once again to relieve the stress. At this point you’re low on cash, so you get back to hustlin’…

If you can identify with this picture, then you, my friend, have fallen into the trap of…

The wannabe rich.

But don’t worry – there’s a way out of this endless loop.

But before we dive into the nuts and bolts of getting out of this trap – let me tell you what this article is not about:

-

- Passive income sermons

-

- Investment advice (no cryptocurrency or “diversification” tips)

-

- Escaping society and becoming a hippie or a monk

-

- Managing your business financials or accounting

-

- Complicated formulas for budgeting

-

- “How to make more money.”

If you’re a freelancer, agency owner, or anyone who, despite earning $5k, $10k (or more), still runs out of money… then this article is for you 🙂

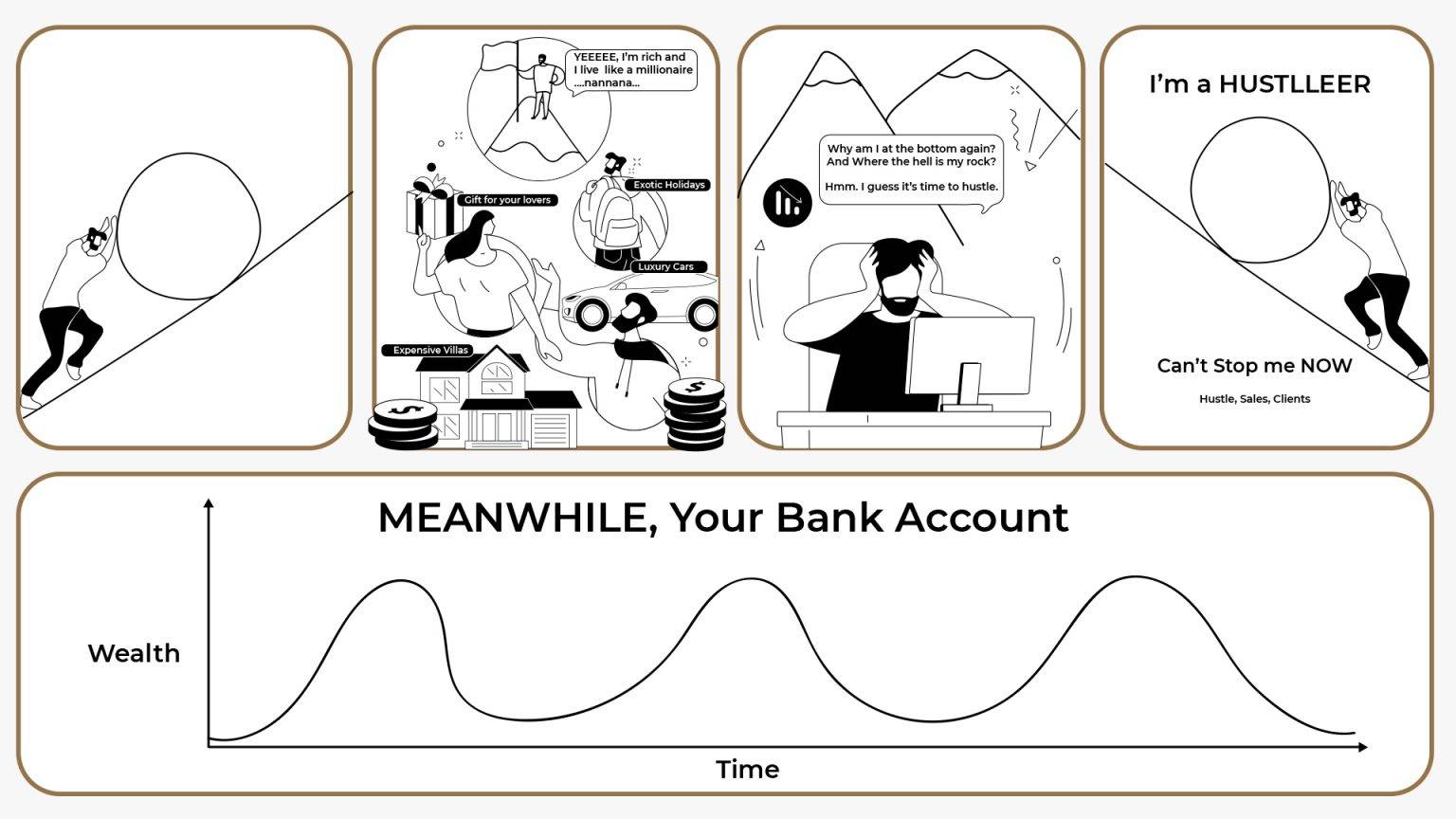

What Separates the Wannabe Rich from the Truly Wealthy

On the right (Figure 2.), you can see the high-level comparison that distinguishes the wannabe rich from the truly wealthy. The list could go on and on, but you probably get the point.

The reason for this duality is the difference in mindsets.

The wannabe rich have learned how to make money (or got lucky) but have no idea how to keep it, manage it and grow their wealth.

And when we are on this topic, let’s address one of the biggest misconceptions…

There’s a vast ocean of differences between wealth & money.

Money is how we transfer wealth. Wealth is everything you own.

The wealthy folks know both… how to make money (Offense) and how to keep the money they make (Defense). Let’s explore this analogy further…

Defense and Offense Also Applies To Managing Money

“You never know who’s swimming naked until the tide goes out.”

Warren Buffet

Every game without exception, from tennis, through Call of Duty to business, requires two distinct forms of play: Offense and defense.

Offense can be defined in terms such as: score, kill, grow, sell, gain, pitch, push, close.

Defense can be defined by terms such as: save, reduce, protect, maintain, guard, preserve.

Offense is all about “how can I win.”

Defense is all about “how can I not lose.”

Every game requires both. In basketball, there’s a saying: “Offense wins games, defense wins championships.”

When you’re winning, and all your shots go in – there’s an illusion of immortality. This illusion makes you think that: “scoring droughts won’t happen to me.” “I can sustain this level of offensive intensity forever.” “I’m immune to injuries and sickness.”

With a few exceptions (and you might be one of the lucky few)

The question is: are you in it for the long haul?

Dissecting Your Spending Motives: The Traps of Consumerism & Mimetic Desire That Suck Us In

We can’t get into the how before we address the why. Why do we keep throwing all our money away?

I’ve been able to dig out the following three reasons:

1) We Want to Belong To the “Cool Kids”

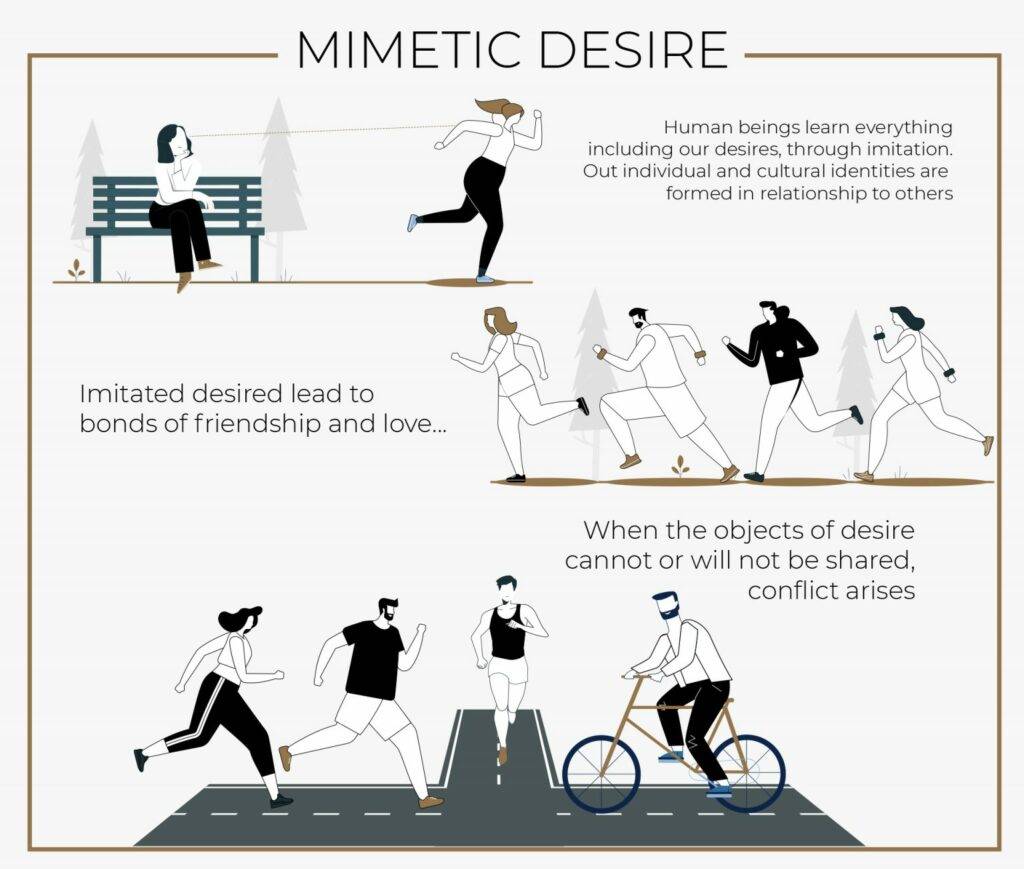

You see their “cool” villas, cars, and models and want to be like them. So-called – Mimetic Desire that Rene Girard has written about. (check Figure 3.)

In short:

You want the things you want because other people want them. There’s a scarce object of desire. The more scarce, the more desirable it is. Hence, expensive cars, beautiful girls, and exotic villas attract so many of us.

Solution: Grow up. If you want to sit at the “cool kids” table, go back to high school. “Coolness” is a high-school currency, and its usefulness ends at the point of graduation.

2) We Want to Be Part of “The Group.”

The entrepreneurs you surround yourself with, who may or may not be ahead of you, dine & wine expensively. Or do all the other stuff I mentioned above. In this case, you want to belong to the group. There’s a group, and you want to be part of it. If you want to spend time with them, you must do what they do.

Solution: If you want to belong, you need to find another group that aligns with your values and goals.

3) Pain → Reward

You work hard, hassle, and grind, even though you hate the work itself. Thus you “deserve” to reward yourself once you put some wins on the board.

Solution: Find meaning and satisfaction in your struggle OR change what you do.

The Budget Stories We Tell Ourselves: Where the Hell Did My Money Go?

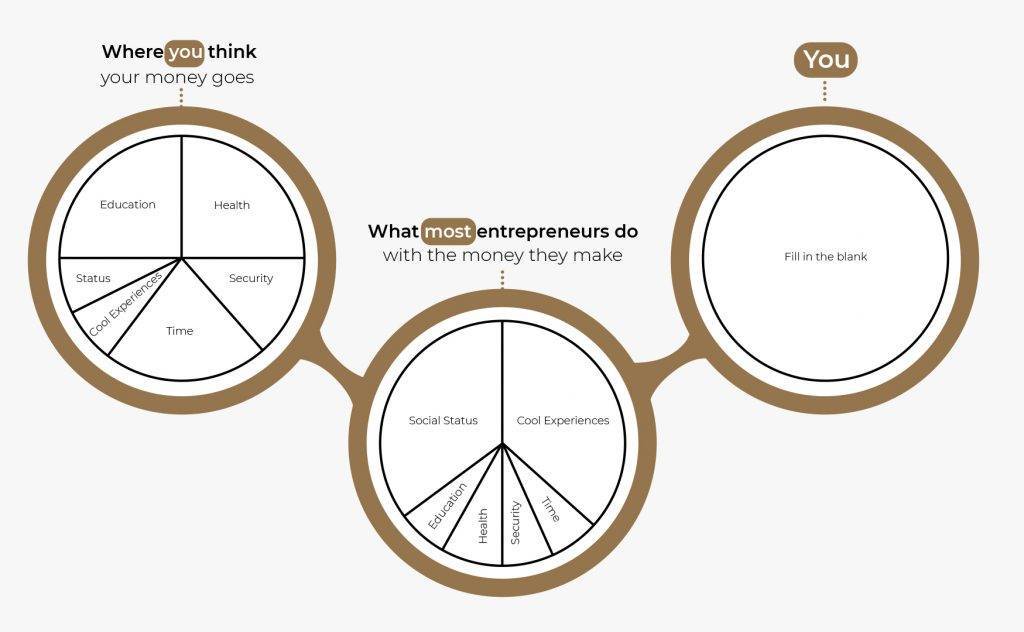

Okay, at this point, you may be “getting it.” Or not. Nevertheless, I created an exercise to pull us out of abstraction and into reality.

The lesson that comes with this exercise is a painful lesson I had to learn myself. In my mind, I would spend my money in very productive ways. When I tested my story, the reality turned out completely different.

The exercise is called: Face the Uncomfortable Truth

Look at the image above (Figure 4.). On the far left is the “Story” you’re likely telling yourself. In the middle is likely the reality based on my experience and dealing with hundreds of other entrepreneurs. On the far right is a space for your truth.

No one is here to judge – your money is yours, spend however you like. The goal is to become AWARE of the numbers.

Awareness is curative.

Putting Theory into Practice: How to Manage Money for Long-term Financial Independence

1. Know Your Nut… Numbers

This one has been beaten to death but is the foundation for every other step.

Our little brains are too biased and clever with making up stories. This means you need to look at your numbers by extracting them from your head and onto a paper/spreadsheet.

In steps, it would look something like this:

- Export your bank statements for the ENTIRE past 1 month

- Export expenses for the last full month. For example – if today is 20th October, you do it for 1st-30th September.

- Tag each expense with a category. For example, list of categories, check Figure 3. on the right.

- Health – fitness like a gym coach, gym membership, supplements.

- Car – petrol, insurance, tires, fixes.

- Groceries – big grocery shopping.

- Insurance – health and life insurance, private medical insurance.

- Restaurants – eating out.

- Travel – petrol when traveling, restaurants while traveling, expenses while traveling.

- Fun – fun things you do ex. cinema.

- Shopping – clothes.

- Bills – phone bill, internet bill, utilities, Spotify, Netflix.

- Commuting – uber rides, taxis, commuting around the city you are at.

- Electronics – new phones, computer screens.

- Visualize it: Make a summary pie chart divided by categories.

- Reflect & Think:

- How much do you want to spend on each category

- Where should you leave it as it is?

- Where should you spend more?

- Where should you spend less?

2. Get Off That Hedonic Treadmill By Using Your Creative Genius

People who live far below their means enjoy freedom people busy upgrading their lifestyles can’t fathom.

Naval Ravikant

If you upgrade your lifestyle at the same rate, you increase your income… you get stuck on the hedonic treadmill, more commonly phrased as the “rat race.” You make more but spend more, so you’re never able to get ahead… and stay ahead.

The solution: Get your creative juices flowin’

Many roads lead to Rome – think about how to fulfill the same needs or desires using fewer resources (money).

3. Hack Your Subconscious Through Mimetic Desire

This one should come naturally to most of you. Simply sell your friends and family on this idea. Talk about your realization, and spread the wisdom. First, your family and friends will thank you for it (at some point ).

Second, if the people you surround yourself with believe that NOT spending money is cool, then you leverage the Mimetic Desire in your favor. Keeping money becomes the object of desire rather than spending it. Win-win.

Seeing Past the Illusion And the Steps Ahead

In the end, no matter your reflections, there are two paths you can take:

a) Keep trying to make more money

b) Commit to applying one or a couple of the abovementioned strategies.

The biggest obstacle in front of you, and all of us, is our desire for freedom.

We don’t want to be “Forced” to do anything. We became entrepreneurs to be free to do anything we wanted. And that applies to spending our hard-earned money.

Psychologically, it’s an internal conflict between “want” and “should.”

My experience and many entrepreneurs I coached tell me that true freedom comes from discipline and structure.

When you don’t run around like a chicken, constantly reacting to the latest & greatest emergency….

…life becomes better, not worse.

I choose freedom FROM (stress, disease, lack of money), over the freedom TO (do anything I want, spend however I want, etc.).

What about you? Are you going to start playing some defense?

~ Konrad “Yerba Mate Addict” & J. Matt Laker

Originally published here.